Access IRS Tax Form s. Complete, Edit or Print Tax Form s Instantly. Confidence and Peace of Mind That Your Tax Filing Will Be Done Correctly. File Your Tax es Without Leaving Home.

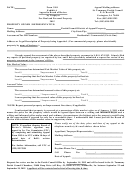

Individual Income Tax Return. Your source of income must come from the following: Wages, salaries and tips. To use this tax form , you must not have a taxable income that exceeds $1000 and you must claim the standard deduction instead of itemizing your deductions. IRS Use Only—Do not write or staple in this space.

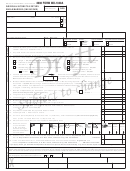

Multiply the number of exemptions claimed on line by the exemption amount shown in the instructions for line for the year you are amending. Enter the result here and on line 4a on page of this form. Free for Simple Tax Returns. See all full list on irs.

Maximum Refund Guaranteed. Securely Import and Autofill Data. Do Your Taxes Anytime, Anywhere. Need to Get Started on Your Taxes. Get a Jumpstart On Your Taxes! Connect With A Live Tax CPA. Available Nights And Weekends.

To change or amend a filed and accepted tax return , learn how to amend a federal tax return. To amend a state tax return , download amended state forms to complete, sign, and mail to your state tax agency. Forms To view a complete listing of forms for individual income tax , please visit the forms page.

Claim for Refund on Behalf of Deceased Taxpayer. Form 1- Arizona Resident Personal Income Tax Booklet. To file a state tax return , select a state and download state tax return income forms. You can also find state tax deadlines. Can be filed by taxpayers using any of the filing status options: single, head of househol surviving spouses, and couples who file married filing jointly or married filing separately.

Browse them all here. If filed before the due date, will allow a taxpayer an automatic extension of six months to file Form IT-20 Resident Income Tax Return , or Form IT-20 Nonresident and Part-Year Resident Income Tax Return. A Tax Agent Will Answer in Minutes!

Questions Answered Every Seconds. It itemizes allowable deductions in respect to income, rather than standard deductions. They are due each year on April of the year after the tax year in question. For more information about the Federal Income Tax , see the Federal Income Tax page. Module Simulation.

Though you might not be working when you receive distributions from your pension, you may still owe income taxes on the withdrawals. Its official name is U. And it used to calculate how much must be paid or refunded by the government.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.