Free for Simple Tax Returns. Maximum Refund Guaranteed. The Tax Division is a part of River City Bank, a family owned bank in Louisville, Kentucky.

The tax refund anticipation loan is not provided by the U. Refund Anticipation Loan or RAL is an income tax loan service offered by very few income tax preparation services. Treasury or the IRS and is.

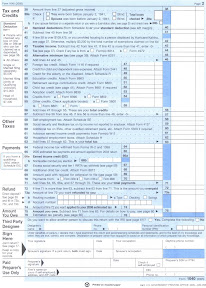

A tax refund anticipation loan can be approved in a manner of minutes and the money accessible within a day or two. These loans are based on the full amount of the tax refund. If you own rental real estate, you should be aware of your federal tax responsibilities. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

The RAL industry is under attack by both the IRS and the federal banking regulators. As of this moment two tax preparation firms have some RAL type products (Jackson Hewitt and Liberty Tax). Others are working on getting those products.

Possibly the wrong number was listed for you MWP (making work pay) benefit.

Then the RAL could have been denied - not rejected. Your refund is now on. Just jumping is will be a major injustice to your clients.

I received my income tax refund on a HR Block Emerald Car which deducted the processing fee from the rebate. Because the refund has a routing number assigned to the emerald car will i get my stiumulus check deposited into HR Bank? They are offered starting in December through the end of the tax season in April. Taxpayers are generally charged fees and interest to obtain a RAL.

Just like any other loan, the full amount of the RAL. A refund anticipation loan (RAL), sometimes called a rapid refund or instant refun is a type of refund option offered by tax preparation companies. RALs are often advertised as a quick way to access an income tax refund through a cash loan. TPG takes the tax preparation fees out of the refun making it easy to pay for tax preparation.

Tax refund is available the same day the IRS issues the automated payment. TaxNet Financial Inc. Refund anticipation loan ( RAL ) is a short-term consumer loan in the United States provided by a third party against an expected tax refund for the duration it takes the tax authority to pay the refund. It also is the most expensive — at least, for users of its paid product tiers.

Loan is subject to underwriting and approval. TurboTax eliminated an. It is not your actual tax refund.

The following loan amounts are available: $50 $80 $30 $50 $00 $75 $250. You can choose to receive your tax refund transfer in a number of different ways. If you choose a State Refund Transfer, it will be disbursed using the same method you choose for your Federal Refund Transfer.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.