Understand Your IRS Notice. Foreign Electronic Payments. IVES, Historic Easement, U. The balance for each tax year for which you owe. Up to months of your payment history. Key information from your current tax year return as originally filed.

Choose the card payment processor below that offers you the best fees for your card type and payment amount. Department of the Treasury. The length of the outage is approximate and subject to change.

Thank you for you patience. CHAPS payments usually reach HMRC the same working day if you pay within your bank’s processing times. Bacs payments usually take working days. The payment needs to exactly match the amount that is shown on the tax return.

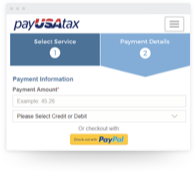

You can only pay for one transaction per payment. Use your credit or debit card to pay personal or business taxes. Make A Personal Payment. Debit card convenience fee.

Credit card convenience fee. This system is solely for paying Federal tax payments and not State tax payments. Visit the Board of Appeals’ Online Petition Center for further information on tax appeals. More info for Pay your personal income tax.

Information on Assessments and Notices. If you can’t make your tax payment in full, pay as much as you can with your tax return. After you are billed for the balance, y ou can set up a payment plan online through MassTaxConnect. Find out how to make payment for the different tax types. All Of The Care And Expertise With Transparent Pricing.

Payment plans are generally limited to months. Benefit from ExamineJobs. On successful login, enter payment details at the bank site. This counterfoil is proof of payment being made.

Treasurer-Tax Collector If you have been impacted directly by COVID-1 complete and submit a COVID-Penalty Cancellation Request form and payment of base taxes between April and June to have penalties and costs cancelled. These details are auto-picked from your Form-26AS and auto-filled in the schedule. It is advisable to check these with the details of the challan of the tax paid to ensure there is no mis-match. We still offer conventional payment methods, too.

Change taxpayer information. To change or correct taxpayer name or mailing address, complete and submit the change. STATEMENT FROM KEITH KNOX, TREASURER AND TAX COLLECTOR , REGARDING COVID-AND THE APRIL PROPERTY TAX DEADLINE. I understand that this is a very stressful time, especially for those suffering direct effects from this public health crisis, and my office is committed to helping in any way we can.

The Boone County Treasurer’s Office is the collection agency for Boone County Tax Revenue. Office hours are 8am – 4pm, Monday through Friday. Courthouse offices are closed on legal holidays and Election Day. The NCDOR is committed to helping taxpayers comply with tax laws in order to fund public services benefiting the people of North Carolina. Intax Pay is the gateway for Hoosiers to pay their tax bills and set up payment arrangements.

This tool is available to customers who owe individual income taxes , and businesses who conduct retail sales. If you are a new visitor to the site, please click on the button below (Individual Eligibility or RRMC Eligibility) to learn more. Pay Council Tax online or by other methods such as direct debit.

For example SW1A 2AA Find. What you need to know.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.