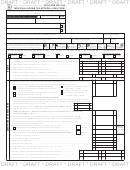

Individual Income Tax Return. IRS Use Only—Do not write or staple in this space. See separate instructions. Your first name and initial. Once blank is done, click Done.

For more information on tax benefits for education, see Pub. The Taxpayer Advocate Service (TAS) is an independent organization within the Internal Revenue Service ( IRS ) that helps taxpayers and protects taxpayer rights. How to make a fillable PDF? Have other payments, such as an amount paid with a request for an extension to file or excess social security tax withheld. Attach any supporting documents and new or changed forms and schedules.

Remember to keep a copy of this form for your records. No software installation. Figuring and Claiming the EIC. This is a tax form that was released by the Internal Revenue Service ( IRS ) - a subdivision of the U. Department of the Treasury. Check the official IRS -issued instructions before completing and submitting the form.

Personal income tax return filed by resident taxpayers. You may file Form 1only if you (and your spouse, if married filing a joint return) are full year residents of Arizona. Make needed corrections to an original tax return online with PDF templates. Download your file or save it for further actions.

Filling out the form is a simple process and they do a lot of the. Federal Self-Employment Contribution Statement for Residents of Puerto Rico. All went well except for one thing. Form 11-C: Occupational Tax and Registration Return for Wagering. Application for Enrollment to Practice Before the Internal.

Forms and Publications (PDF). Most US citizens, and resident aliens, are required to file an individual tax return to the federal government every year. Federally tax-exempt interest and dividend income 2. It will be used if you need to amend a tax form that you filed in a previous tax year. This could be used if you were married but did not file correctly or if you made a mistake on your tax filing forms in a prior tax year.

This form will require the exact information you used on the previous tax form. The form is divided into sections where you can report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Fill out required blank fields with your data in a few clicks. Add your signature from any device.

Be sure in safety and quality of the services. Yes No If “Yes,” attach an explanation. Enter California seller’s permit number, if any Check if the LIFO inventory method was adopted this taxable year for any goods.

If checke attach federal Form 9If the LIFO inventory method was used for this taxable year, enter the amount of closing inventory under LIFO.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.