Please look for help first here on IRS. In order to use this application, your browser must be. Use the Where’s My Refund? IRS is offering coronavirus relief to taxpayers. Access IRS forms, instructions and publications in.

You can start checking on the status of you return within hours after the IRS received your e-filed return , or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than days, but some may take longer. Track your refund status using the free IRS2Go app. You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer.

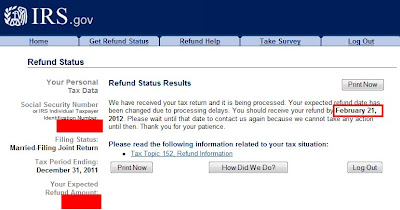

Refund Status Thank you for using the IRS web site to obtain your tax information. Whether you owe taxes or you’re expecting a refund , you can find out your tax return ’s status by: Using the IRS Where’s My Refund tool. You can check on the status of your refund hours after you e-file.

If you filed a paper return , please allow weeks before checking on the status. Tax Advisor Will Answer in Minutes! Questions Answered Every Seconds.

It will tell you when your return is in received status and if your refund is in approved or sent status. What is happening when Where’s My Refund ? We have your tax return and are processing it. How to Check on the Status of an IRS Tax Return. Keeping track of your tax return during processing makes sense.

Whether you expect a refund or you filed an amended return , keeping current on your. Generally you can get tax refund information hours after the IRS has acknowledged the receipt of your e-filed tax return , or three to four weeks after mailing a paper tax return. Before you check your tax refund status under Step below, make sure you have a copy of your tax return handy. There is no right to privacy in this system.

Unauthorized use of this system is prohibited and subject to criminal and civil penalties, including all penalties applicable to willful unauthorized. How to check the status of a mailed paper return you already sent ? I filed my federal return online, however, I was informed to mail out my return by paper. I would like to know how I can check the status of my return and if the IRS has received it. Identify the return you wish to check the refund status for.

If it is incorrect click New Search. The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. We are experiencing a high volume of. Illinois Department of Revenue has initiated the refund process.

The following security code is necessary to prevent unauthorized use of this web site.

If you are using a screen reading program, select listen to have the number announced. See How Easy It Really Is! Us Deal with the IRS. Get Peace of Mind Support Guarantee!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.