Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. No Installation Needed. Convert PDF to Editable Online. IRS Use Only—Do not write or staple in this space.

Select your state(s) and complete the forms online, then downloa print and mail them to the state(s). The mailing address is on the main state home page. Find out whether you have to file , how to file , where to file , how to get an extension of time to file and more. NO, that is not correct! With $6of self-employment income you will owe $in self-employment tax.

Health Insurance Mar-ketplace and wish to claim the premium tax credit on line 45. However, you do not need to wait to receive this form to file your return. You may rely on other information received from your employer. Requirement to reconcile advance payments of the premi-um tax credit.

File late taxes today with our Maximum Refund Guarantee. For details, see Pub. The due date is April 1 instead of April 1 because of the Emancipation Day holiday in the Dis- trict of Columbia—even if you do not live in the District of Columbia. If you are not sure about your filing status, see instructions.

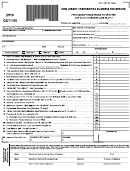

Information from its description page there is shown below. Figuring and Claiming the EIC. FreeTaxUSA , a TaxHawk, Inc. Residents: Multiply Line by 3. Cannot be less than zero.

Nonresidents and part-year residents: Enter the tax from Schedule NR. Recapture of investment tax credits. Have questions about COVID-19? So much time spent on paperwork… File in minutes using a simple online form. Prevent new tax liens from being imposed on you.

Download blank or fill out online in PDF format. Secure and trusted digital platform! Also, if your return is accepte you should not try to amend your return until it has been fully processed and you have received your refund or your payment has cleared.

I found following info in taxact website:The IRS allows electronic filing of tax returns for the current tax year and the two previous tax years. Tax Table See the instructions for line to see if you must use the Tax Table below to figure your tax. Brown are filing a joint return.

Attachment Sequence No. Your social security number. Medical and Dental Expenses. Caution: Do not include expenses reimbursed or paid by others. This is a popular but outdated post so we wanted you to know.

You will need to locate instructions for the referenced form or schedule to complete it.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.