Is My Business Tax Exempt ? What types of business are tax exempt? What organizations are tax exempt? What qualifies you to be tax exempt? See all full list on irs.

Nonprofit entities are organized under state law to engage in charitable activities. These same entities can request an exemption from corporate taxes from the Internal Revenue Service. The Internal Revenue Code restricts the activities that tax-exempt organizations can carry out. Fortunately, Streamlined Sales Tax (SST) makes the process easier — whether you’re selling to tax-exempt organizations or you need an exemption for your own business.

The Streamlined Tax Exemption Certificate is valid in member states and the District of Columbia,. Find tax exemptions for your small business by consulting experts on which exemptions exist for small businesses , and claiming those you are eligible for. A tax-exempt organization, such as an elementary or high school, makes a purchase for items needed for the school.

Not all purchases made by a retail business are necessarily exempt from sales tax. Tax-exempt refers to income or transactions that are free from tax at the federal, state, or local level. The tax-exempt article is not part of any tax calculations. Once you have followed the steps outlined on this page, you will need to determine what type of tax-exempt status you want.

Form 990-N (e-Postcard) is an annual electronic notice most small tax-exempt organizations (annual gross receipts normally $50or less) are eligible to file instead of Form 9or Form 990-EZ. Users may also download a complete list. Individuals or businesses may qualify to make tax exempt purchases. Our Amazon Tax Exemption Program (ATEP) supports tax exempt purchases for sales sold by Amazon. The Amazon Tax Exemption Wizard takes you through a self-guided process of enrollment.

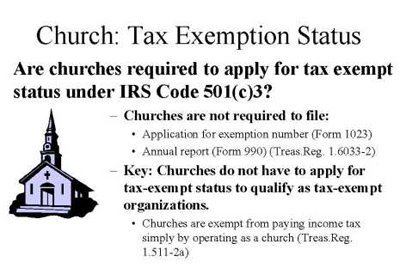

In other words, tax forms require many important pieces of information, and if those pieces are incorrect or missing, then the consequences can be the same as accepting the wrong foryour business could be on the hook for the uncollected sales tax. If you are an aspiring entrepreneur and are unsure of which tax publications may be relevant to you, please consult our Starting a Business section, which provides an overview of your federal tax responsibilities. Types of Tax Exempt Organizations Generally, an annual return (Form 99 990-EZ, or 990-PF, as appropriate) or an annual notice (Form 990-N) is required to be filed by by every tax exempt organization unless an exception applies. State law exempts gross receipts from services provided by medical, dental, legal, and educational providers and certain services provided by nonprofit membership organizations.

Services by religious and charitable organizations and veterinary services are also exempt from business tax. Click here to download the pdf form.

Other Tax - Exempt Organizations Miscellaneous types of organizations that qualify for exemption from federal income tax. Business tax consists of two separate taxes: the state business tax and the city business tax. Tax Forms Business Registration FormsCurrently selected. With a few exceptions, all businesses that sell goods or services must pay the state business tax.

This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state. The BIRT is based on both gross receipts and net income. Both parts must be filed. Department of Revenue - Taxation. Skip to main content.

Electronic Funds Transfer. Payment Options by Tax Type. How To Make a Payment. Set Up a Payment Plan. Delinquent Taxpayer List. Direct Deposit Refund. Lost, Missing or Destroyed. Change Refund Address.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.