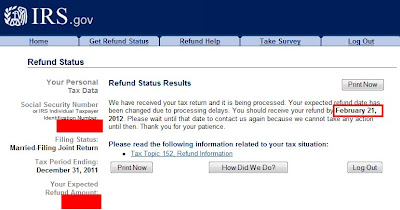

The IRS issues most refunds in less than days, although some require additional time. You should only call if it has been: days or more since you e-filed weeks or more. Tax Season Refund Frequently Asked Questions.

You can start checking on the status of you return within hours after the IRS received your e-filed return, or four weeks after mailing a paper return. Generally, the IRS issues most refunds in less than days, but some may take longer.

Track your refund status using the free IRS2Go app. The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. States can ask the IRS to intercept, or offset, federal tax refunds for state tax obligations or.

Tax Court said in a memorandum opinion. Yes, tax season is still happening. And even though the IRS pushed back Tax Day to July 1 it’s a good idea to file your income taxes sooner rather than later — especially if you’re expecting a refund.

Residency rules vary from state to state.

The following security code is necessary to prevent unauthorized use of this web site. If you are using a screen reading program, select listen to have the number announced. How to determine your state tax refund status? How do I check the status of my state refund?

How long it normally takes to receive a refund. Some tax returns need extra review for accuracy, completeness, and to protect taxpayers from fraud and identity theft. Extra processing time may be necessary.

If you received a refund amount different than the amount on your tax. The Department of Revenue is protecting Georgia taxpayers from tax fraud. All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia. Illinois Department of Revenue has initiated the refund process. Welcome to the Ohio Department of Taxation refund inquiry web form.

Tax refund offsets - applying all or part of your refund toward eligible debts. If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied.

State Tax Department, Agency. Where Is My State Tax Refund ? Before you check your state income tax refund , please make sure your state tax return has been accepted. If you e-filed your state income tax return via efile. On the first page you will see if your state income tax return got. In order to use this application, your browser must be configured to accept session cookies.

Identify the return you wish to check the refund status for. If it is incorrect click New Search. Please review the information. Roy Cooper has ordered all US and NC flags at state facilities to be lowered to half-staff until sunset Sunday, February 1 in honor of NC Native Sgt.

We are experiencing a high volume of. Javier Jaguar Gutierrez, who lost his life during an attack in Afghanistan. Gutierrez’s service, and our prayers are with his loved ones and all who are mourning.

Check the status of your state tax refund. Access this secure Web site to find out if the Division of Taxation received your return and whether your refund was processed. Refund 1is the fastest way to get the latest information about your Wisconsin tax refund.

Social Security Number (SSN) or Individual Tax Id (ITIN). By using this system, you are receiving the same information an agent would provide. Enter in whole dollars only.

What information do I need? This website provides information about the various taxes administere access to online filing, and forms.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.