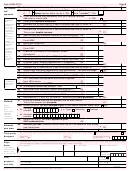

If you plan to itemize your deductions, you will need to fill out and attach. Other articles from filemytaxesonline. IRS Use Only—Do not write or staple in this space.

Pick the right one and it could make a big difference in your tax bill. Learn more about taxes at Bankrate. IRS deposited the first Economic Impact Payments into taxpayers’ bank accounts today. Access IRS Tax Form s. Complete, Edit or Print Tax Form s Instantly.

See How Easy It Really Is Today. Take full advantage of a electronic solution to develop, edit and sign contracts in PDF or Word format online. Transform them into templates for multiple use, add fillable fields to gather recipients?

Its official name is U. And it used to calculate how much must be paid or refunded by the government. Forms To view a complete listing of forms for individual income tax , please visit the forms page. It itemizes allowable deductions in respect to income, rather than standard deductions. They are due each year on April of the year after the tax year in question.

IRS as far as taxes owed either way. The mailing address liste here are for your IRS federal tax returns only - not state tax returns. It’s for people and older.

Read more below about how it works and what’s different about it. If you’re filing your return using tax software. To change or amend a filed and accepted tax return , learn how to amend a federal tax return. To amend a state tax return , download amended state forms to complete, sign, and mail to your state tax agency. Many of the IRS forms and instructions are published late in December of each year.

Click the F and I icons to download. Find the forms you need - Choose Current year forms or Past year forms, and select By form number or By tax type. Federal Tax Form Downloads. The form is divided into sections where you can report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Depending on the type of income you report, it may be necessary.

You could also claim dependents and take tax credits for child and. Arizona Nonresident Personal Income Tax Booklet. Free for Simple Tax Returns. Maximum Refund Guaranteed. Securely Import and Autofill Data.

Do Your Taxes Anytime, Anywhere. Still wondering which IRS tax form should I use? All of the forms use the same tables to calculate your income tax liability. What are the requirements for filing the easiest tax form ? This is not the actual tax return form.

This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund. It should not be used for any other purpose, such as preparing a federal income tax return , or to estimate anything other than your own personal tax liability. What’s New for Illinois Income Tax.

Did you know you can file this form online? INDIVIDUAL INCOME TAX. Form 140PY - Part-Year Resident Personal Income Form. Individual Tax Forms. Application for Special Bonus Game.

Bingo Verification Form. Financial Report – Class A License.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.