IRS Use Only—Do not write or staple in this space. Correcting Your Tax Return. Social Security Benefit Statement. Protect yourself from identify theft.

Federal Self-Employment Contribution Statement for Residents of Puerto Rico. For businesses and other taxpayer audiences, see the links to the left. The IRS Volunteer Income Tax Assistance (VITA) and the.

Certain individual and corporate income tax filing and payment due dates have been extended days. Connecticut Earned Income Tax Credit. Part-Year Resident Income Allocation Worksheet. See How Easy It Really Is Today. Tax Table and Tax Rate Schedules.

When and Where Should You File? Type or print in blue or black ink. Include Schedule AMD) 1. Welcome to The Mississippi Department of Revenue. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

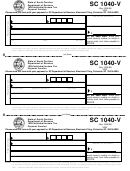

Complete, Edit or Print Tax Forms Instantly. Access IRS Tax Forms. Filing online is quick and easy! INDIVIDUAL INCOME TAX.

Forms To view a complete listing of forms for individual income tax , please visit the forms page. What are my Payment Options? Get Your Maximum Refund Guaranteed. Every resident of North Dakota who has a federal income tax filing requirement is required to file a North Dakota individual income tax return. This requirement applies even if all or part of the resident's income is derived from sources outside of North Dakota.

Individual Shared Responsibility Provision. Most people must file their tax return by May 1. Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year. The Department collects or processes individual income tax , fiduciary tax, estate tax returns, and property tax credit claims.

Information and online services regarding your taxes. The Ohio Department of Taxation provides the collection and administration of most state taxes, several local taxes and the oversight of real property taxation in Ohio. Taxes Site - Income Tax Forms.

The department also distributes revenue to local governments, libraries and school districts.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.