A Tax Agent Will Answer in Minutes! Questions Answered Every Seconds. What is advance payment of tax? How to setup an IRS payment plan? How high your adjusted gross income was — the higher your income , the less you’ll get Americans can get up to $2per person with an additional $5dollars per dependent.

This estimate shall be computed by the assessee for his own use as this is not required to be submitted to the Income Tax Dept. This is straight from the IRS website, hope this helps. At this time very doubtful because it is very possible that you could be having some delay in receiving your CLAIMED anticipated REFUND $$$$ AMOUNT from the United State Treasury Department because. ITNS 2and pay your advance tax just comply with the basic requirements bank account with net.

To pay advance taxes , you’ll first need to calculate quarterly payments, then remit the amount due on the four due dates spread throughout the tax year. Tax refund loans are essentially short-term advances on a tax refund you expect to get. The loan amount is deducted from your refund after it’s issued. Available amounts range from $2to $500. For instance, your monthly earnings is very important in determining the maximum amount that you can get.

If you happen to have a big monthly salary, chances are, you can get a bigger advance. This amount is based on your federal refund amount, personal info, tax info, and any third-party data we may consider. Overdraft fees and get cash advance from Today!

Easy Online Application. No early payout fees. We Can Help - Apply now! The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail. An assessee who is liable to pay advance tax is required to estimate his current income.

Prepaid membership dues received by an auto club one year in advance were includible in income by an accrual basis taxpayer, since they are held under a claim of right without restriction on their disposition. The advance tax payments are made in instalments as per the specified due dates by the income tax department. The flowing receipt of advance tax helps the Government in managing the expenses.

X pays this Income Tax in advance i. However, this amount of advance income tax shall be adjusted against actual income tax payable on actual income of Mr. The refund advance loan is an offer from First Century Bank. If approve you will receive a cash advance in the amount of $25 $50 $7or $000.

You first must meet certain eligibility requirements such as having a sufficient tax refund from the IRS, and provide appropriate identification. You then submit an application to Axos Bank, the lender. A tax advance loan is based on your actual refund so there is no credit check and no upfront fees to pay. All tax advances are $2and $finance fee even if your actual IRS refund is delayed. Tax Preparation fees apply and are non-refundable.

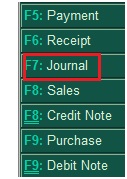

On the government’s tax information network, select Challan No. On the e-payment page, fill the correct applicable tax type, PAN details,. Fill in all the required details and chose ‘ (100). Among direct taxes, income tax is the main source of revenue. It is a progressive tax system.

Income tax is imposed on the basis of ability to pay. It aims at ensuring equity and social justice.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.