The IRS urges taxpayers who are owed a refund to file as quickly as possible. This year, however, the IRS has changed tax filing deadlines as a result of coronavirus. The Internal Revenue Service (IRS) late Friday announced the deadline for recipients of Supplemental. The Oregon Department of Revenue on Tuesday announced an expansion of the types of tax returns for which filing and payment deadlines have been extended due to COVID-19. Tax Deadline Changed.

IRS is offering coronavirus relief to taxpayers. An extension provides an extra six months to file your return. Payment of the tax is still due by April 15. You can submit payment for any taxes you owe along with the extension form.

Other articles from thebalance. The federal tax-filing deadline has moved to July , and the IRS will waive penalties and interest on tax payments Treasury Secretary Steven Mnuchin announced last month that the tax-filing. This policy includes estimated payments. No action is required from businesses to take advantage of this extension policy in Philadelphia. Get updates for California taxpayers affected by the COVID-pandemic.

Anyone that misses the deadline to file should be advised to make payment of any tax due via a return payment on MassTaxConnect. On March 2 Treasury Secretary Steven Mnuchin announced on Twitter that the tax - filing deadline will move to July 1 the same day tax payments are due. Does the relief provided in the Notice apply to the filing of information returns?

July is also the deadline to file for an extension to file your individual tax return. Department of Revenue (NCDOR) recently announced that they will extend the April tax filing deadline to July for individual, corporate, and franchise taxes to mirror the announced deadline change from the Internal Revenue Service. Read the notice about this change for all the details. BOSTON — Governor Charlie Baker, Lt. Click here to find out more.

Listed below are typical tax filing deadlines for each month, some may fall on a Holiday or Saturday or Sunday. In that case it will be need to be postmarked on the next business day. Questions Answered Every Seconds. In addition to the filing extension, the NCDOR will not charge penalties for those filing and paying their taxes after April 1 as long as they file and pay their tax before the updated July deadline.

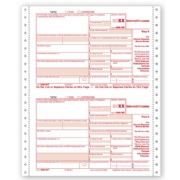

However, the department cannot offer relief from interest charged to filings after April 15. Individual tax returns due. If you income is below $60for the tax year, you can e-file for free using IRS Free File.

If your income was above that, you can use the IRS’ free, fillable forms. The IRS can assess a failure-to-pay penalty worth up to of your unpaid tax. Filing after the deadline can cost you.

And if your return is more than days late, the IRS assesses a minimum tax penalty of $2or 1 of the tax you owe, whichever is less. This means taxpayers will have an additional days to file from the original deadline of April 15.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.