See How Easy It Really Is Today. How can I get my Wonline? How to obtain your W-online? Check the box for Form W-, specify which tax year (s) you nee and mail or fax the completed form.

Allow business days from the IRS received date to receive the transcript. If the form is lost, missing, or you can’t find it online , contact your employer immediately. It’s a good idea to call the IRS if you don’t receive the Wby mid-February.

Employers are required to send W-forms by January each year or the next business day if the date falls on a weekend or holiday. However, you may not need to wait on the mail. The IRS will send your employer a letter requesting that they provide you with a corrected Form W-within ten days. The letter advises your employer of their responsibilities to provide a corrected Form W-and of the penalties for their failure to do so. At the beginning of the year, you usually receive this form.

Every employer must provide employees who received at least $6over the year, a Wform. Therefore, you need this document to determine your earnings. Both of these companies can look-up the company you work for, or they can use your Employer Identification Number to find your W2. The W-form is a form prepared by employers, of the wages made and taxes paid out by the worker.

This record consists of income, commissions and tips, along with the money held back for state, federal and social security taxes throughout the prior year’s employment. Supplying W-’s on the internet means. Also, provide a Form W-2c to the employee as soon as possible. To correct a Form W-you have already submitte file a Form W-2c with a separate Form W-3c for each year needing correction.

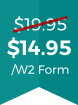

Get Your Max Refund Today. Securely Import and Autofill Data. Do Your Taxes Anytime, Anywhere. Bigger Refund or Larger Paychecks? Print an Updated W-4. Free for Simple Tax Returns. Maximum Refund Guaranteed.

Plus, they are built to ease every step of the tax filing process. Each service has their own price point and service metho though. A paper copy of your W-form from Walmart will be available by January 31. If you choose to receive it electronically, you can get it even sooner.

For step-by-step directions on how to get your W-form electronically, visit the Online Wpage on OneWalmart. If you’ve separated within months, you can login to your myPay account to get your W2. If you can’t access your myPay account, you can submit a tax statement request and we’ll mail you a hard copy. This document asks you to estimate your wages and taxes withheld last year. Again, your final pay stub can help provide these figures.

Contact the Social Security Administration if your employer does not send you your W-by February 14th. Request a Duplicate Form W-2. You may be able to get a. This normally occurs by January 15th of each year.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.