See How Easy It Really Is Today. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Use this schedule to figure the credit for the elderly or the disabled.

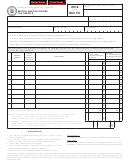

Individual Income Tax Return. IRS Use Only—Do not write or staple in this space. Single Married filing jointly.

LatestForms to make sure you have the latest version of forms, instructions, and publications. The amount shown where the taxable income line and filing status column meet is $658. This column must also be used by a qualifying widow(er).

The type and rule above prints on all proofs including departmental reproduction proofs. SR and their instructions, such as legislation enacted after they were publishe go to IRS. Maximum Refund Guaranteed. Free for Simple Tax Returns. Securely Import and Autofill Data.

Do Your Taxes Anytime, Anywhere. Need to Get Started on Your Taxes. Get a Jumpstart On Your Taxes! The main purpose of this document is to register your total taxable revenue and determine the amount of your annual tax back. Publication 5- Residential Rental Property (Including Rental of Vacation Homes) - Reporting Rental Income, Expenses, and Losses.

Schedule will be a common form that many. Advance Payment of the Premium Tax Credit (APTC) Alternative Minimum Tax (AMT) How to Determine the Excess APTC That Must be Repaid. The IRS issues more than out of refunds in less than days.

Pay for TurboTax out of your federal refund: A $Refund Processing Service fee applies to this payment method. Prices are subject to change without notice. Special Instructions for Bona Fide Residents Of Puerto Rico Who Must File A U. No Installation Needed.

Convert PDF to Editable Online. Major changes are taking place this year in the way we prepare our income tax forms. Wage and salary income, investment income from interest and dividends, and Social Security and retirement. The activity described in the schedule qualifies as a business if its primary purpose is income or profit and taxpayers are involved in the activity with continuity and regularity. Fill out required blank fields with your data in a few clicks.

Add your signature from any device. Be sure in safety and quality of the services.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.