The IRS issues most refunds in less than days, although some require additional time. You should only call if it has been: days or more since you e-filed weeks or more. Refund information for the most current tax year you filed. All or part of your refund may have been used (offset) to. Coronavirus (COVID-19) Tax Relief.

In order to use this application, your browser must be.

The tool will provide an actual refund date as soon as the. Find filing information for Federal ,. The federal tax refund is often the largest single check. Access IRS forms, instructions and publications in.

If you have filed your federal income taxes and expect to receive a refund , you can track its status. Have your Social Security number, filing status, and the exact whole dollar amount of your refund ready. How do you find your federal tax refund?

How to contact the IRS about a refund?

What is a federal income tax refund? Where does your federal refund come from? When it comes to filing a federal tax return , there are a few questions that people care about more than any other – how much am I paying on taxes, how much will I get back in my tax refund , and when will I receive it? Everything else, they say, is just details. Other articles from themilitarywallet.

Pay for TurboTax out of your federal refund : A $Refund Processing Service fee applies to this payment method. Prices are subject to change without notice. Taxpayers can start checking on the status of their return within hours after the IRS received their e-filed return , or four weeks after they mail a paper return. IRS receives the tax return , then approves the refund , and sends the refund. Extension to File Your Tax Return.

If you can’t file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service (IRS). File Federal Taxes Fast, Easy, And Free! Maximum Refund Guaranteed. Join The Millions Today! Complete, Edit or Print Tax Forms Instantly.

Nonresident Alien Income Tax Return. At this time, refunds are still being processed on schedule according to the United States Department of Treasury.

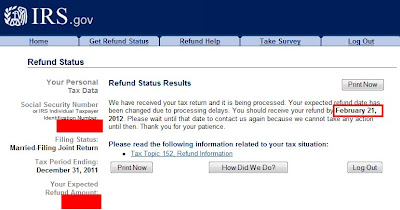

Refund Status Thank you for using the IRS web site to obtain your tax information. What we’ve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund. Generally, you can expect to receive your state tax refund within days if you filed your tax return electronically.

Where is my federal tax return it has been more than weeks and I still have not received it The IRS no longer processes returns in first in first out batches. They are processed individually so returns sent in at the same time will not necessarily process together. Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities.

There is no right to privacy in this system. Unauthorized use of this system is prohibited and subject to criminal and civil penalties, including all penalties applicable to willful unauthorized. This feeling is somewhat misguided because the tax is only refunded because the person paid too much tax. Easily file federal and state income tax returns with 1 accuracy to get your maximum tax refund guaranteed.

Start for free today and join the millions who file with TurboTax.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.