Refund information for the most current tax year you filed. Coronavirus (COVID-19) Tax Relief. In order to use this application, your browser must be.

The IRS issues more than out of refunds in less than 21. Find filing information for Federal ,.

IRS cannot process mailed forms due to coronavirus. Access IRS forms, instructions and publications in. You may be prompted to change your address online. You can also call the IRS to check on the status of your refund. States can ask the IRS to intercept, or offset, federal tax refunds for state tax obligations or.

Many of the most common errors made on federal income tax returns can be avoided simply by filing. Individual Tax Returns by State. Do you have to pay taxes on IRS refund?

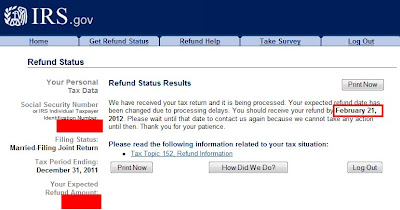

Refund Status Thank you for using the IRS web site to obtain your tax information. How do I Find my IRS tax refund? How to contact the IRS about a refund? Can the IRS take or Hold my refund? We are regularly updating our Economic Impact Payments and Get My Payment application frequently asked questions pages so check back often for the latest additions that answer many common questions.

The Get Transcript Service is for individual taxpayers to retrieve their own transcripts for their own purposes. IRS deposited the first Economic Impact Payments into taxpayers’ bank accounts today. Let Us Deal with the IRS.

Tax Advisor Will Answer in Minutes! Questions Answered Every Seconds. Free for Simple Tax Returns. Maximum Refund Guaranteed. Connect With A Live Tax CPA. Available Nights And Weekends.

Tax Refund Schedule: When Will I Get My Money Back? Pay for TurboTax out of your federal refund : A $Refund Processing Service fee applies to this payment method. Prices are subject to change without notice.

At this time, refunds are still being processed on schedule according to the United States Department of Treasury. Keep in mind it can still take a week to receive your refund after the IRS releases it. Whatever is left, if anything, will be refunded to you in the way you requested on your tax return.

What we’ve covered so far applies to federal tax refunds. As you might expect, every state does things a little differently when it comes to issuing tax refund. Generally, you can expect to receive your state tax refund within days if you filed your tax return electronically. As of right now, the delays may cost taxpayers around a week or longer than the estimated tax refund dates. The Internal Revenue Service reminds taxpayers and tax professionals to use electronic options to support social distancing and speed the processing of tax returns, refunds and payments.

Agency Details AcronyIRS. Tax Reform Information and Services. Contact the Internal Revenue Service. Taxpayer Advocate Service. Learn how to check your refund status in minutes.

Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.