The IRS issues most refunds in less than days, although some require additional time. You should only call if it has been: days or more since you e-filed weeks or more. Refund information for the most current tax year you filed. Coronavirus (COVID-19) Tax Relief.

In order to use this application, your browser must be.

Join the eight in taxpayers who get their refunds faster. Find Form 9and apply for and maintain your organization’s. The federal tax refund is often the largest single check. You may be prompted to change your address online. You can also call the IRS to check on the status of your refund.

What does my tax refund status mean? How do I Check my tax refund status? How to contact the IRS about a refund?

Is tax refund from the IRS taxable? You can check on the status of your refund hours after you e-file. If you filed a paper return , please allow weeks before checking on the status.

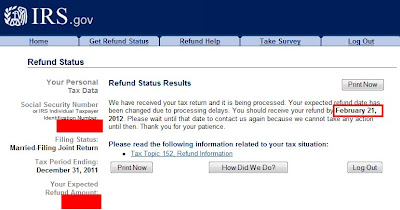

States can ask the IRS to intercept, or offset, federal tax refunds for state tax obligations or. Refund Status Thank you for using the IRS web site to obtain your tax information. Many of the most common errors made on federal income tax returns can be avoided simply by filing. Tax Court said in a memorandum opinion. Illustration of a tax refund process.

On-Line Taxes can assist you with the status of your tax return , however we do not know the status of your refund from the IRS or your State. The IRS makes no promises, but here's what you can guess based on what the tax agency says about its track record. Tax Refund Schedule: When Will I Get My Money Back? You should be able to check IRS tax refund status roughly hours after your receive confirmation from the IRS that they have received your tax refund via E-File.

A Tax Agent Will Answer in Minutes! Use TurboTax, IRS, and state resources to track your tax refund , check return status , and learn about common delays. Questions Answered Every Seconds. Other ways to check your tax refund status.

You will need the same three pieces of information as those who use the online tool, so be sure you have a copy of your tax return available.

Find out when you can expect your refund from the IRS. You will be directed to the IRS Web site and need the following information: Please note: Depending on how you chose to receive your refund , you may need to allow an additional two to five business days from the date indicated by the IRS for your bank to. At this time, refunds are still being processed on schedule according to the United States Department of Treasury. First, check your refund status.

It’s helpful to know the official status of your refund. Here’s how to find out: IRS. In past years, about of filers receives refunds after filing their federal income tax returns.

Many people even count on a refund to help them pay down debt or cover bills early in the year. That means a delayed refund can cause problems for some. To find out the status of your refund , you’ll need to contact your state tax agency or visit your state’s Department of Revenue.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.