Let Us Deal with the IRS. Free for Simple Tax Returns. Maximum Refund Guaranteed. TurboTax Audit Support Guarantee. Need more time to prepare your federal tax return?

This page provides information on how to apply for an extension of time to file. The Montgomery County Tax Office is providing a four-month extension of all property payment. See all full list on irs. The form comes with a list of addresses telling you where to send the form and your.

A Tax Extension give you an additional months to file your Tax Return, making your new deadline October 15. It is not an extension of time to pay your tax bill. How to get non filing letter IRS? Can I report someone to IRS?

It’s Convenient, Safe, and Secure. We are regularly updating our Economic Impact Payments and Get My Payment application frequently asked questions pages so check back often for the latest additions that answer many common questions. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! The FAQ notes that HSA contributions for a particular year may be made at any time during that year or by the tax return filing due date for that year.

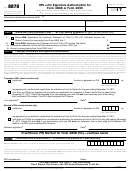

An extension to file is not an extension to pay any taxes owed. If you need more time , don’t wait too long to ask the IRS. Application for Automatic Extension of Time to File U. The extension is limited to six (6) months.

No additional extension of time to file will be granted beyond the six months unless the taxpayer is outside the continental limits of the United States. These extensions do not grant you an extension of time to pay any tax you owe. MyTax Illinois is an easy way to pay your IL-505-I payment. Complete, Edit or Print Tax Forms Instantly.

IRS Taxes Made Simple. When you need more time to complete your taxes, whether because of something as serious as a global health scare or as simple as sheer procrastination, all you need to do. Trump announces extension of tax deadline for coronavirus victims, including businesses. Real- time last sale data for U. Traditionally, federal tax returns are due on April or the first business day thereafter. Common reasons for requesting an extension include a lack of organization, unanticipated events or tax planning purposes.

Industry-Specific Deductions. Get Every Dollar You Deserve. There are several ways to request an automatic extension of time to file your return. Internal Revenue Service. Individual Income Tax Return.

To request an extension to file income tax returns after the due date, use the form that applies to you. Interest or penalties may be charged on any tax not paid by the regular due date of the return. However, an extension of time for filing a tax return does not extend the time for paying the tax due. If you do not pay the amount of tax due by the statutory due date, you will owe a ten percent () late payment penalty, and interest.

If you claim this extension , write Combat Zone on the top of your return and on the envelope.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.