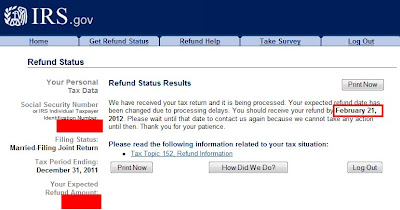

Each state sets its own schedule for processing tax returns, but sometimes situations change how they process returns. In a mayonnaise jar on Funk and Wagnall's back porch where it has been since 3:PM yesterday. Returns mailed to Department of Revenue state. I checked online for the status of my refund AGAIN.

Simply: to (or create) your Individual Online Services account.

Select your name in the upper right-hand corner of your Account Summary. Select Preferences, then choose Electronic communications from the expanded menu. How long it normally takes to receive a refund.

Some tax returns need extra review for accuracy, completeness, and to protect taxpayers from fraud and identity theft. Extra processing time may be necessary. If you received a refund amount different than the amount on your tax. If you filed electronically and received a confirmation from your tax preparation software, we have received your return.

You can expect your refund to move through our review process.

The Indiana Department of Revenue screens every return in order to protect taxpayer IDs and refunds. A DOR representative will be happy to assist you. Tax refund offsets - applying all or part of your refund toward eligible debts. If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills.

We will send you a letter explaining the specific bills and how much of your refund was applied. Both options are available hours a day, seven days a week. These automated systems can tell you if and when we will issue your refund. Illinois Department of Revenue has initiated the refund process.

Stage - Refund Approved Stage - Refund Issued Enter the required information below to find out the stage and a more specific status of your refund. If you visit the Indiana Department of Revenue’s website, you can find its Refund Status Service. Simply enter your SSN and refund amount to check the status of your refund.

The system shows where in the process your refund is. When ready, you will see the date your refund was sent. Every return we receive is different, so processing time will vary.

The links below will take you step-by-step through the return process. Protecting Your Refund Identity and refund theft are on the rise. The Wisconsin Department of Revenue is safeguarding you and your refund from identity theft, fraud and errors.

Check the status of your state tax refund. Access this secure Web site to find out if the Division of Taxation received your return and whether your refund was processed. The Department of Revenue is protecting Georgia taxpayers from tax fraud.

You can check the status of your Oklahoma income tax refund for the current year by one of the following ways: Visiting our online Taxpayer Access Point You will be required to give the last seven digits of the primary (first) social security number or individual taxpayer identification number (ITIN) on the return, the amount of the anticipated. Enter the exact refund amount shown on your Kentucky tax return in whole dollars only. You must enter the exact refund amount in whole dollars only.

Prior year and amended return processing may require in excess of. The following security code is necessary to prevent unauthorized use of this web site. If you are using a screen reading program, select listen to have the number announced.

Find Out How Long To Get Your Refund.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.