Refund information for the most current tax year you filed. Tax Season Refund Frequently Asked Questions. Coronavirus (COVID-19) Tax Relief. Use the Where’s My Refund? You can start checking on the status of you return within hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than days, but some may take longer.

Track your refund status using the free IRS2Go app. If you have filed your federal income taxes and expect to receive a refund , you can track its status. Have your Social Security number, filing status , and the exact whole dollar amount of your refund ready. You can also check the status of your one-time coronavirus stimulus check. States can ask the IRS to intercept, or offset, federal tax refunds for state tax obligations or.

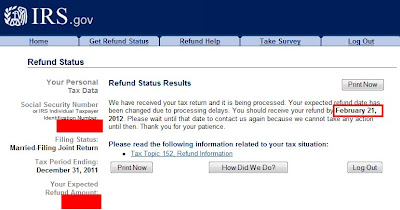

If you are eligible to receive a stimulus check from the government as a result of the coronavirus. Taxpayers can start checking on the status of their return within hours after the IRS received their e-filed return, or four weeks after they mail a paper return. Refund Status Thank you for using the IRS web site to obtain your tax information.

IRS receives the tax return, then approves the refund , and sends the refund.

In order to use this application, your browser must be configured to accept session cookies. Please ensure that support for session cookies is enabled in your browser. How do I Check my tax refund status? Does the IRS Owe you a refund? How to check on IRS refund?

But, the Address Change and Refund Trace features are not available at certain scheduled times. Get to Your Tax Questions. You can check on the status of your refund hours after you e-file. If you filed a paper return, please allow weeks before checking on the status.

When your love note from the IRS will arrive depends on when you file how you filed and what you filed. However, the IRS does provide a way to get more specific information about your refund. Where’s My Tax Refund , a step-by-step guide on how to find the status of your IRS or state tax refund. Check the Status of Your Income Tax Refunds ! On-Line Taxes can assist you with the status of your tax return, however we do not know the status of your refund from the IRS or your State.

Keep in mind it can still take a week to receive your refund after the IRS releases it. This tax refund table can give you a rough idea of when you may be able to expect your tax refund. Taxpayers who submitted their tax returns early this year may have to wait a little longer than anticipated to receive their tax.

There is no need to login. Then, enter your SSN and the refund amount you claimed on your current year income tax return.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.