Get Your Max Refund Today. Securely Import and Autofill Data. Do Your Taxes Anytime, Anywhere. Free for Simple Tax Returns. Maximum Refund Guaranteed. Bigger Refund or Larger Paychecks? Print an Updated W-4. How to obtain my Wform?

The quickest way to obtain a copy of your current year Form W-is through your employer. Many companies, including the military, have made their employees W-form easy to get online. When is a W-2c required? Where Can I Find and Download My W-2?

Does Zenefits have consent to issue W-2s electronically? There is an alternative – downloading your W-from the Web. Some of the major W-preparers now offer this service. Your employer must for this option.

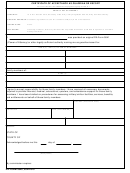

A W-form is used for filing taxes. It is a form that an employer must fill out and then provide to the employee during the tax filing season. Answer a few simple questions.

Form W- Wage and Tax Statement, shows the income and taxes withheld from an employee’s pay for the year. Taxpayers need it to file an accurate tax return. Here are some common reasons: There’s a quick way to get all the information statements filed under your taxpayer identification number (usually, your Social Security Number) for the past years. Just ask the IRS for your wage and income transcript.

However, you may not need to wait on the mail. Search for your employer’s name. Access IRS Tax Forms. To order a W-form from the IRS, go to the IRS. Just remember that when you eventually do get your W-or W-2C, you are going to.

In some cases, W-forms are available for several previous years. W-forms are sent out annually by employers as a statement of earnings for the previous year. I have added information to my answer below. Why wait for a copy of your Wto come in the mail, when it, and your refun are only a click away? The W-form is how you report total annual wages to your employees and the IRS.

It is the employer’s responsibility to fill out the form correctly and file it on time. This tool will explain each of the fields in a standard W-form. Click on a box below for more information. Filing taxes after you've separated.

Employee-related data. If you’ve separated within months, you can login to your myPay account to get your W2. If you can’t access your myPay account, you can submit a tax statement request and we’ll mail you a hard copy. If you’re missing your W-, contact your employer before contacting the IRS. If you haven’t received a W-by January 3 contact your employer.

Welcome to ADP W-Services. Click to and enter your user name and password.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.