Maximum Refund Guaranteed. Free for Simple Tax Returns. Industry-Specific Deductions. Get Every Dollar You Deserve. Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years.

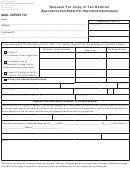

Mail the request to the appropriate IRS office listed on the form. People who live in a federally declared disaster area can get a free copy. The fee per copy is $50. An IRS transcript is a summary or overview of your tax return information.

There are five types. Step 3—Choose the tax years you want returns for. Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities.

How to find my tax return? Unauthorized use of this system is prohibited and subject to criminal and civil penalties, including all penalties applicable to willful unauthorized. Easily file federal and state income tax returns with 1 accuracy to get your maximum tax refund guaranteed. Start for free today and join the millions who file with TurboTax. Claim a tax refund You may be able to get a tax refund (rebate) if you’ve paid too much tax.

A Tax Agent Will Answer in Minutes! Questions Answered Every Seconds. Connect With A Live Tax CPA. Available Nights And Weekends.

For example, the Tax Return Transcript provides the most line items, including your adjusted gross income. Luckily, the process for retrieving these forms is simple. Allow for your shipment to complete before submitting a request. Request a Tax Refund. Tax refunds cannot be issued until your shipment is delivered successfully.

To request a refund for your TurboTax product, complete this form. Access IRS Tax Forms. Department in determining whether the refund should be granted.

If you are requesting a sales and use tax refund , you must first refund or credit the tax back to your customer, and include documentation of this with your claim. However, we can process your request and will send copies to the individual who signed the return at the address on file with the Division of Taxation. Businesses Any return filed through the On-line Services Filing and Payment Services can be obtained by logging on with your Business Identification Number and assigned PIN number.

Where do I mail my tax forms? Did you get a letter? Subscribe to Revenue Emails. Header Utility Narrow. Georgia Tax Center Help. Individual Income Taxes.

By state law, sales and excise tax returns for any monthly tax period are generally due on the th day of the. This website provides information about the various taxes administere access to online filing, and forms. Visit us to learn about your tax responsibilities, check your refund status, and use our online services—anywhere, any time!

Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.