What does my tax refund status mean? How do I check the status of my tax refund? In order to use this application, your browser must be configured to accept session cookies.

Taxpayers can view status of refund days after their refund has been sent by the Assessing Officer to the Refund Banker. Refund Status Thank you for using the IRS web site to obtain your tax information. The Indiana Department of Revenue screens every return in order to protect taxpayer IDs and refunds.

A DOR representative will be happy to assist you. The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. What Is the Status of My State Tax Return ? To see if your state tax return was receive you can check with your state’s revenue or taxation website. There, you can find out whether your refund is being processed or get further contact information to confirm that your return was received. Is Your Tax Refund Lower Than You Expected?

If you received a refund amount different than the amount on your tax return , we’ll mail you a letter. Wait for that letter before you contact us.

You must contact us to check the status of a prior year tax refund. Identify the return you wish to check the refund status for. If it is incorrect click New Search.

Please review the information. We are experiencing a high volume of. Welcome to the Ohio Department of Taxation refund inquiry web form. Individual Income Tax Return , for this year and up to three prior years. You must enter the exact refund amount in whole dollars only.

Prior year and amended return processing may require in excess of. Check the status of your tax refund. You may track your tax return and refund status online using myVTax, our online filing system. The Department employs many review and fraud prevention measures in order to safeguard taxpayer funds. Both options are available hours a day, seven days a week.

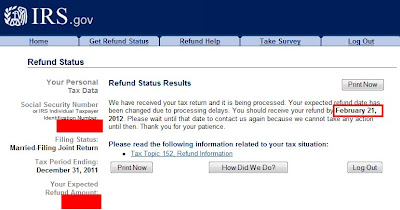

These automated systems can tell you if and when we will issue your refund. The system shows where in the process your refund is. When ready, you will see the date your refund was sent.

Every return we receive is different, so processing time will vary.

The links below will take you step-by-step through the return process. If you filed electronically and received a confirmation from your tax preparation software, we have received your return. You can expect your refund to move through our review process. Refund 1is the fastest way to get the latest information about your Wisconsin tax refund. Select Tax Return Year.

Use our Where’s my Refund tool or call 804. When can you start checking your refund status ? Enter in whole dollars only.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.