Find Out How Long To Get Your Refund. Direct Deposit Refund. You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or you’re expecting a refund , you can find out your tax return ’s status by: Using the IRS Where’s My Refund tool.

Refund Status Thank you for using the IRS web site to obtain your tax information.

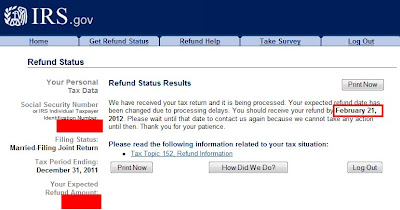

Taxpayers can start checking on the status of their return within hours after the IRS received their e-filed return , or four weeks after they mail a paper return. IRS receives the tax return , then approves the refund , and sends the refund. You may track your tax return and refund status online using myVTax, our online filing system.

In order to use this application, your browser must be configured to accept session cookies. What does my tax refund status mean? How do I track my refund status?

When in IRS noncollectable status will you receive tax refund?

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. Taxpayers can view status of refund days after their refund has been sent by the Assessing Officer to the Refund Banker. How long it normally takes to receive a refund.

Some tax returns need extra review for accuracy, completeness, and to protect taxpayers from fraud and identity theft. Extra processing time may be necessary. If you received a refund amount different than the amount on your tax.

Check the status of your tax refund. Refund Amount Whole dollars, no special characters. Obtaining taxpayer account information is the privilege of individual taxpayers or their authorized representatives. Unauthorized access to account information is unlawful as described in Section 502. Identify the return you wish to check the refund status for.

We are unable to locate your tax return using the information you provided. If it is incorrect click New Search. We are experiencing a high volume of. Please review the information.

As of April the IRS received over 97. To mitigate the spread of COVID-1 staffing is extremely limited and may delay the timeframe to review refund requests. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals.

These additional measures may result in tax refunds not being issued as quickly as in past years. Individual Income Tax. Welcome to the Ohio Department of Taxation refund inquiry web form.

All first-time Georgia income tax filers, or taxpayers who have not filed in Georgia. The Department of Revenue is protecting Georgia taxpayers from tax fraud.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.